Tech Bank Failures: The Impact of Fed Policy on Macroeconomic Stability

The recent collapses of Silicon Valley Bank, Signature Bank, and Silvergate Bank have raised concerns among investors about the potential financial ramifications of bank failures

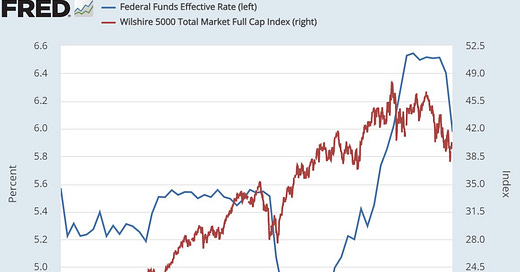

One of the reasons why tech companies are running out of money is due to the Federal Reserve tightening the money supply. M2 money, which includes cash, checking deposits, savings deposits, and other time deposits of less than $100,000, is down -2% year-over-year for the first time in 100 years. Whenever the money supply contracts, banks become vulnerable to collapsing, and this trend has been historically predictable.

In response, the Federal Reserve has already promised to "print money" to ensure that the depositors of Silicon Valley Bank are fully bailed out. This suggests that the tightening of rates and liquidity may be over, and the Fed will likely be repaid most of what they need to print by FDIC, resulting in minimal net change to the money supply.

However, it's crucial to keep an eye on the bigger picture. The abruptness of the recent market movements, along with the fact that funds were significantly short bonds and short rates coming into this period, suggests that we may be seeing a big de-risking short squeeze rather than a careful repricing of the expected path of policy. Just like the bond rally in January, these types of moves can sow the seeds of their own reversal. As such, investors may want to consider diversifying their portfolios with assets that are less vulnerable to sudden market shifts. This could include a mix of stocks, bonds, private equity, and digital assets, depending on individual risk tolerance and investment goals.

The best way forward for policymakers is to continue tightening to slow the real economy while ensuring that the financial system can withstand the shifts in policy by providing the necessary liquidity and capital. The stakes are high, and the right path for policy is clear. The future actions of Jerome Powell and the Federal Reserve will reveal a lot about how policy will be run in the months ahead.

Disclaimer. This post is for general information purposes only. It does not constitute investment advice or a recommendation or solicitation to buy or sell any investment and should not be used in the evaluation of the merits of making any investment decision. It should not be relied upon for accounting, legal or tax advice or investment recommendations.